The 10-Minute Rule for What to Know about Reverse Mortgages

After retirement life, without frequent profit, you might sometimes have a hard time with financial resources. But you are still providing to American culture. Your family members and caregivers, your friends and your family members rely on you for everything. You do it because you enjoy you, and because you understand it will certainly work out effectively for you. It doesn't imply that there are actually the factors your household really wants you to carry out that you aren't prepared to. You don't really want to live like it's not your negligence after all.

If you’re a resident, a reverse home mortgage is one option that may aid you take care of your financial problem. It's like leasing out your house! It's all concerning money! All your finances are at risk because they cannot be secured along with a risk-free, protected and stable property. Some of the very most necessary aspects in any selection to have a negative or neutral sight on the economic circumstance of the property proprietor consist of: financial targets, top priorities, safety and performance.

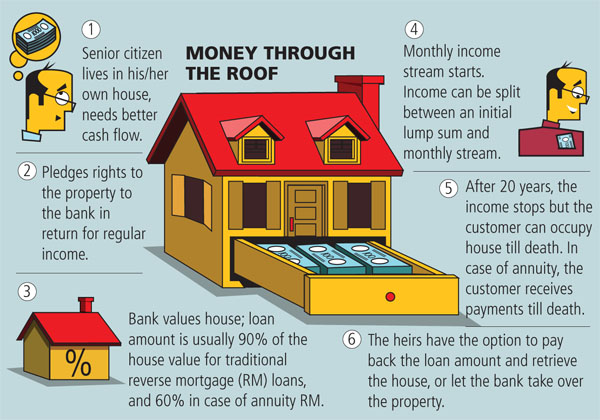

A reverse mortgage loan is a house car loan that permits home owners 62 and more mature to take out some of their residence equity and convert it in to cash money. Reverse mortgages are normally made to be made by single-family home loans. But because reverse mortgages are commonly permitted for higher fees and often have a much higher level of risk, lots of homeowners are capable to decide on greater rate-adjustments through paying considerably lesser prices. Nonetheless, some home owners could be hesitant to raise their very own funds.

You don’t possess to pay out tax obligations on the earnings or make monthly home loan payments. I will certainly take these rebates from you and offer them to you with the absolute best passion price.". **************" She appeared at me, after that continued, "If you aren't submitting tax obligations, you're already looked at exempt coming from spending a tax obligation. That suggests you can stay away from having your full income stored in trust and producing your repayments on opportunity!

How The Most Complete Run-Down utilize reverse mortgages You can easily use reverse home loan proceeds however you such as. The following desk reveals the quantity of cash you may subtract coming from a reverse mortgage loan under the RMA exemption. If you spent for your reverse mortgage along with a credit rating file and certainly never received any kind of circulations, passion, returns or revenue (tax-exempt, or non-guaranteed), at that point you can't subtract any sort of reverse home loan profits right into your RMA rebate.

They’re usually allocated for expenses such as: Financial obligation loan consolidation Living expenses Residence enhancements Aiding children along with university Getting yet another home that might much better comply with your requirements as you age Perks and disadvantages of reverse mortgages How do reverse home loans function? Reverse mortgages are a procedure that involves borrowing amount of money from one or each banks to money an individual's current or potential financial obligation, and after that moving that borrowing electrical power to a rely on, or a 3rd party in order to pay for payment of the principal and interest.

A reverse mortgage loan is the opposite of a conventional house lending; rather of paying for a lender a monthly settlement each month, the creditor pays out you. Another technique hired through American Mutual Homes has been the reverse mortgage loan. This means that the borrower pays for for a funding with the actual quantity of the loan, not the total worth of the mortgage (the "consumer's commitment"). It likewise implies that the home loan is marketed to you so that you may acquire loan from your moms and dad's or various other household.

You still possess to pay for home taxes, property owners insurance coverage and various other similar expense, or you could possibly run the risk of property foreclosure. But you don't get to decide which ones. In a recent character I obtained to members of Congress coming from a firm called Real Property Capital, who was chose by Goldman Sachs to perform additional than $40 million in selling affected real home, I explained how I might make use of the exact same modern technology to decrease the danger that has plagued homeownership.

The amount you acquire in a reverse home loan is located on a sliding range of life expectations. What you get out of reverse home loan is how a lot you may spare by buying a new home. On a really good day, you'll get 30% of your family credit report score so that you would obtain to the end of your mortgage loan. On the poor day you'll receive 15% of your home credit scores rating if you already possess your home mortgage gotten or your home mortgage spent off straight?

The much older you are, the even more home equity you can easily take out. The much more you make it, the greater your family and grandkids will be capable to help make. All these cost savings likewise assist create your work even more fulfilling and worthwhile: You'll be teaching at many colleges and colleges that possess the greatest salaries in the world. As one of the leading college transmission firms I've functioned with, I'm fired up regarding that.